Adaptability and refreshed product ranges for a return to growth

Published on 22 April 2024

Maison&Objet Barometer #8. 1,090 retailers, specifiers, and brands took part in the now-customary Barometer introduced by Maison&Objet. Their stories can be summarized in three words: resilience, reinvention, and optimism. One-third of professionals who responded to the survey were pleased to report an increase in sales over the past 6 months compared to the same period last year, and 36% declared that their results were even with last year. And though 39% reported a drop in sales, this trend should be qualified, depending on the type of business.

Retailers: reinventing themselves to face new challenges

With 43% of them signaling a drop in sales, it was retailers in particular who have spoken of increased difficulties.

The issues they face include competition from online platforms, constant discounting online, higher rents, and even customer behavior. “Customers stop by to check prices and products, but only want to order online so they can feel like they’re receiving a gift at home,” regrets the manager of a French boutique.

The drop in sales observed by retailers between October 2023 and March 2024 adds to the debate around the evolution of these sales channels. “We need to try to think of the most creative way to stay relevant by offering products that are constantly more innovative and design-oriented and by using cutting-edge marketing that’s different from that offered by classic channels,” states an independent retailer from the Oceania region. A concept store in Italy focuses on a parallel online assortment and an offering of services: “We’ll soon be offering regular remote color consultation and, eventually, interior design service”. Such initiatives are unique to each retailer, yet they all address the same issue, which a respondent defined as a “need to reinvent ourselves”.

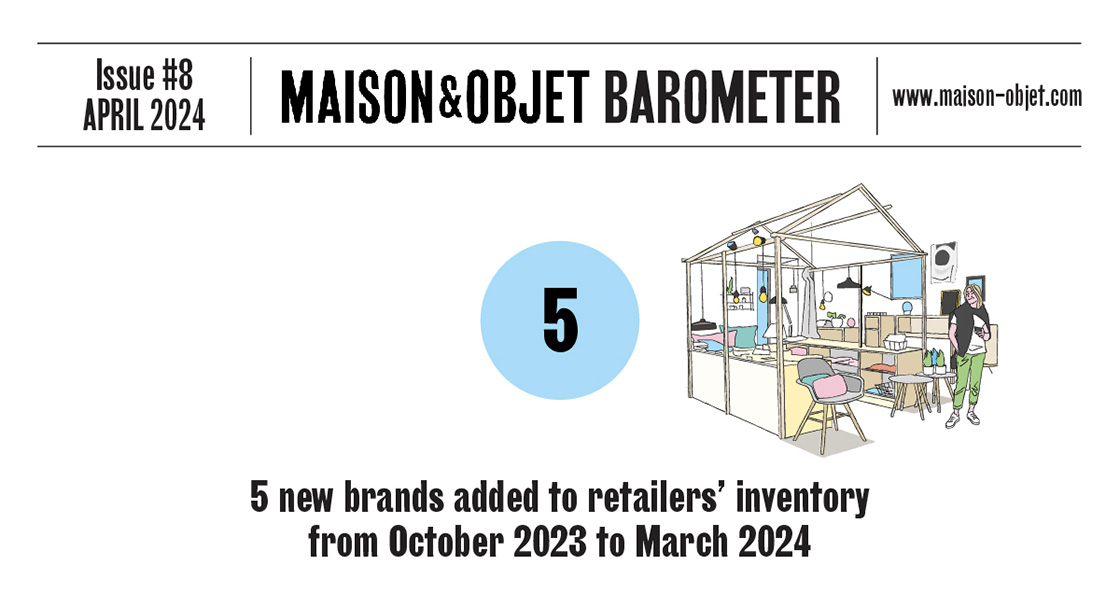

In the meantime, retailers continue to focus persistently on refreshing their assortments to maintain attractiveness, with an average of 5 new brands entering their inventories over the past 6 months.

Diversification and a complementary offer

One avenue for growth may be found in diversifying offerings. If we look into the details in terms of product categories, offerings tied to the world of gifts, impulse buys, and hospitality are showing some momentum. Also, though furniture is slowing down, with 57% of resellers observing a drop in sales volume from October 2023 to March 2024, kitchen, cooking, and gourmet grocery items have held their own and even increased in volume for 27% of professionals who sell them. The sales volume of connected objects has declined, according to 50% of the retailers involved, but that of gift items has risen for 24% of retailers, and fragrances and scents keep the home fires burning, with an increase for 28% of them.

Specifiers in “resilience” mode

“The future looks bright,” proclaims an Australian interior designer, who, without denying the challenges and cost increases at hand, is enthusiastic about the creativity, multitude of talents, and the task of facing up to eco-sustainability. For previous barometers, architects and decorators lamented longer timeframes before signing a project contract, and small-scale work on one or a few rooms…Today, a certain resilience, a desire to stand out from the crowd, and a need for self-renewal that is inherently tied to their field is being highlighted in what they say.

With an average of 6 projects signed up between October 2023 and March 2024, specifiers’ business is showing a certain stability compared to what they told us in recent barometers.

These numbers are once again worth qualifying depending on the type of project, the size of the firm, and the geographic location. Thus, 65% of survey respondents stated that, over the past 6 months, the number of residential projects, the field of play for over 2/3 of specifiers from the Maison&Objet community, stayed the same, or even increased. But if we look more closely, of the 36% who experienced a drop in projects, French stakeholders were particularly affected: this figure was 43% for them, compared to 22% for the rest of the world.

In the specific case of France, economic circumstances were highlighted by observers to explain this notable decline. A lack of rental properties and a drop in real estate transactions, both residential and commercial had an impact. The lowering of mortgage rates to under 4% is nevertheless a good omen for 2024, according to the newspaper Les Echos (1), which reports a leap of 51.8% in the generation of loans in the first quarter and of 46.2% in mortgage loans granted.

In terms of shop, office, hotel, and restaurant projects, large firms are doing better than small agencies and independent specifiers. With an increase of 41% in their workspace projects and 50% for retail projects, compared to 26 and 23% for specifier participants of all sizes, firms with more than 10 employees stand out from the rest in terms of their momentum.

Brands are refreshing their product ranges

89% of brands who responded to the survey stated that they will be offering new products over the next 6 months. These are plans which will therefore become a reality at the fair, with refreshed and expanded product ranges. Statements about inventory levels confirm that producers and manufacturers will fulfill their “segment of the market”, with inventories expected to be “normal” for 54% of professional respondents, and “high” for 29% of them. These figures are, then, relatively steady compared to previous barometers.

Concerns arose in terms of distribution channels. “Difficulties encountered by traditional retail channels are forcing us to change our sales model,” states a French brand. This concern tempers the constancy shown by retailers in stocking new brands, which they’ve shown throughout all our barometers, as demonstrated in the positive outlook for orders.

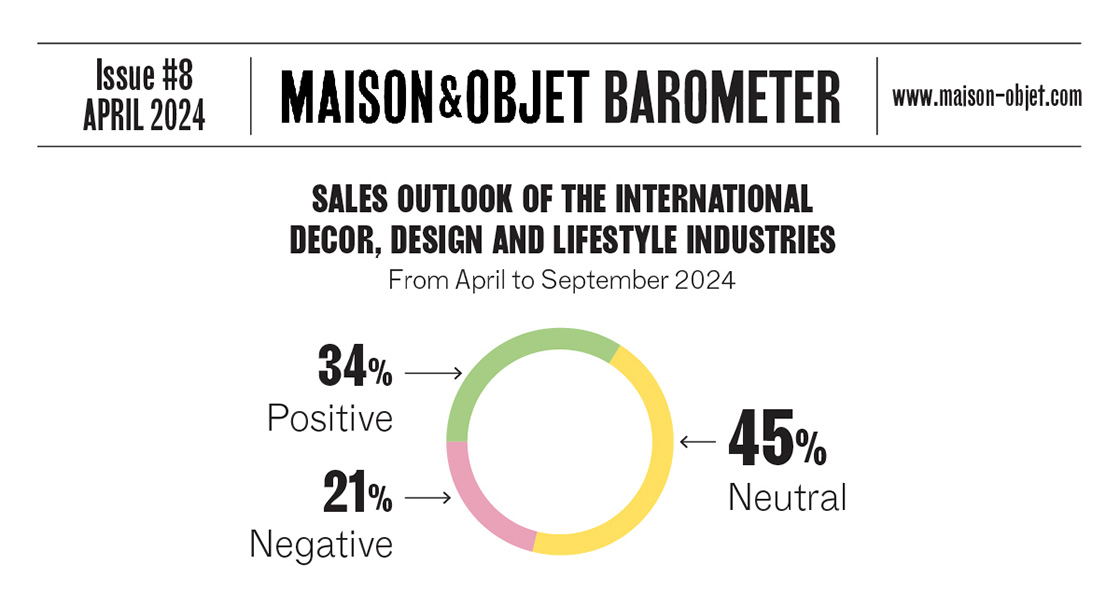

An optimistic outlook

A considerable number of new products expected at the next Maison&Objet Paris fair is not the only positive sign revealed within this latest barometer. An expectation of even or increasing sales from April to September 2024 seems to be the case for 8 out of 10 respondents from all business categories. Recently, the IPEA, the French Institute specializing in the furnishing and decor market, has expressed optimism in terms of the future purchasing habits of consumers who have understood the need to improve their home spaces since the COVID crisis: “Household spending continues to tip in favor of home design and decor”. (2)

Artificial intelligence: an essential tool

Each barometer contains a section devoted to professionals’ perception of a new issue or challenge that the industry is facing. For this edition, our focus was on artificial intelligence. The subject is clearly on everyone’s minds, with 68% of respondents affirming that they clearly understand the concept of AI. It has, in fact, already been integrated into their business by 34% of firms and individuals surveyed on this matter, with, in top position, ChatGPT (89%). Though 84% of stakeholders have stated that AI is an essential working tool for the future, answers have revealed questions about threats to intellectual property, the possible dehumanization of tasks, and also a certain highly pragmatic curiosity about its real benefits. These are the first learnings we can take from these indicators about AI and the home sector, which will be widely detailed and discussed in an upcoming article in the Maison&Objet magazine in early May 2024. Keep an eye out for that…

See our figures on Artificial Intelligence